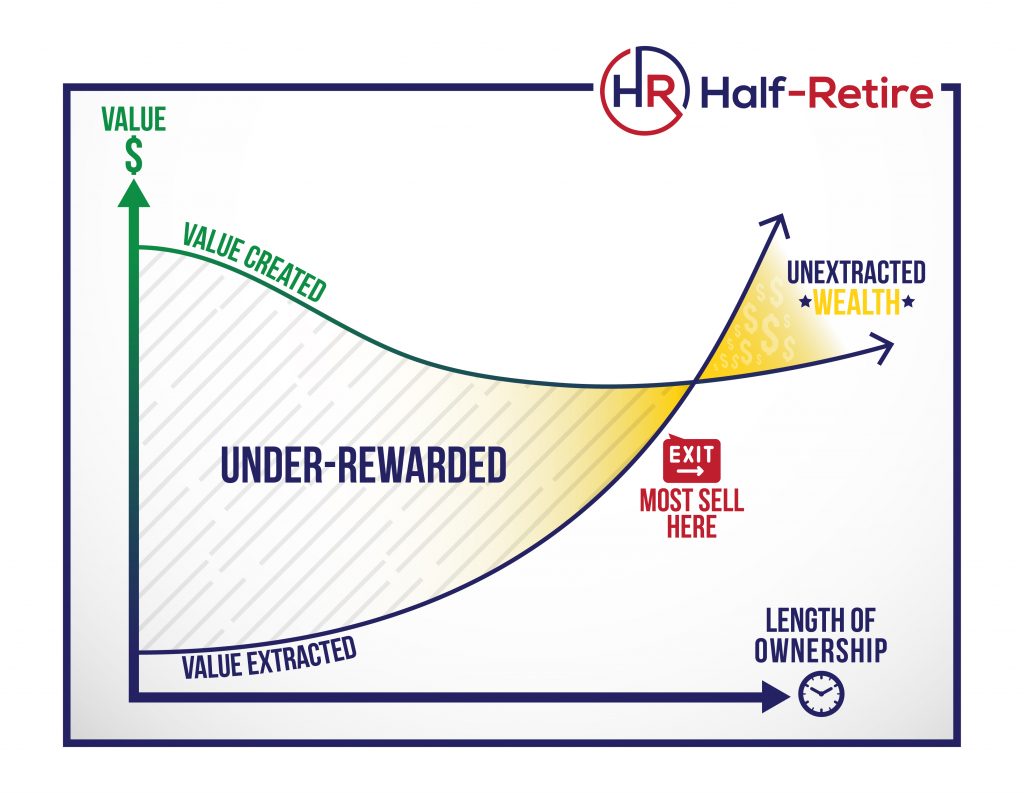

Why are so many business owners delaying the sale of their businesses? No one knows for sure, but it probably has to do with the 44% Rule.

What is the 44% Rule?

The vast majority of small businesses sell for a multiple of annual earnings. More specifically, they sell for two to five times annual earnings. Most business brokers will tell you that budgeting three times annual earnings is a good ballpark estimate for the sales value of your business.

After receiving your lump sum payment, you will have costs associated with the sale (brokers, lawyers, advisors, etc.) plus a tax bill. That will amount to twenty-five percent or so. Let’s use a business that makes $300,000 annually as an example. The math works like this:

$300,000 annual business income times 3X multiple = $900,000 sales price

$900,000 sales price less 25% expenses & taxes= $675,000 investible cash.

If you were receiving $300,000 annually from the business, you would need to make 44.4% investment return on your sales proceeds just to replace the income you used to receive from the business. Download an Excel spreadsheet to run the math.

Why does anyone sell their business?

(Read the full article – 5 Reasons Business Owners Sell When They Shouldn’t)

Read the full article here, but the short version is frustration. Sure, the income from the business is good, but the business owner simply cannot take the daily frustrations of business ownership anymore. So they take a lousy deal and hope for the best.

A new trend: Half-Retirement

The exit planning community predicted that a tidal wave of businesses would flood the exit market as baby boomers turned sixty-five. Books such as The Ten Trillion Dollar Opportunity predicted that there might be too many businesses for sale and cause an imbalance in the market.

This tidal wave never happened

(Read the full article – What Happened to the Tidal Wave of Boomer Businesses for Sale?)

To everyone’s surprise, many boomers did not exit their business at sixty-five. They didn’t pass their business on to their kids. They didn’t do an ESOP. They didn’t do anything resembling an exit. Instead, they found a way to radically reduce the stress of business ownership and keep the income stream.

We call this the Half-Retire Revolution. By keeping control of their income stream, business owners are betting on themselves instead of insurance companies or the stock market. They are refusing to give up the outstanding returns they make on the investment in their business for miniscule bond returns.

By the same token, they are also saying “no” to typical business owner frustrations. By eliminating the non-financial reasons businesses get sold, the owner can enjoy work, enjoy retirement, and enjoy excellent income.

We have seen many business owners succeed in Half-Retirement. It’s not as simple as flipping a light switch; it’s a process. Here are the steps we have seen business owners take to accomplish Half-Retirement:

- Eliminate key frustration points. If you cannot enjoy going in to work, you will eventually sell the business to end the frustration.

- Reduce the business’ dependence upon your work. It’s alright to have the business depend upon your expertise, skill, judgment, and connections, but it’s not alright for the business to need your eight hours of work each day.

- Grow your team into some of the work you currently do. We have a saying, “It’s never as simple as delegation.” There’s a reason you do the work you currently do and have not delegated it to the team. It’s complicated and tricky, BUT, it can be done with a system plus training, coaching, and patience.

- Systematize everything. Most small businesses work because the owner IS the system. Invest in having the systems run your business instead of you running it, and you can escape the day-to-day grind.

- Enjoy the spoils. Half-Retirement offers the best of everything: excellent income, security, and work-life balance. You have worked hard to build this business, now enjoy the rewards!

Sometimes, it’s hard for business owners to imagine anything but the day-to-day grind of the business. If you need some help, read this article: 6 Ways Business Owners Are Enjoying Half-Retirement.