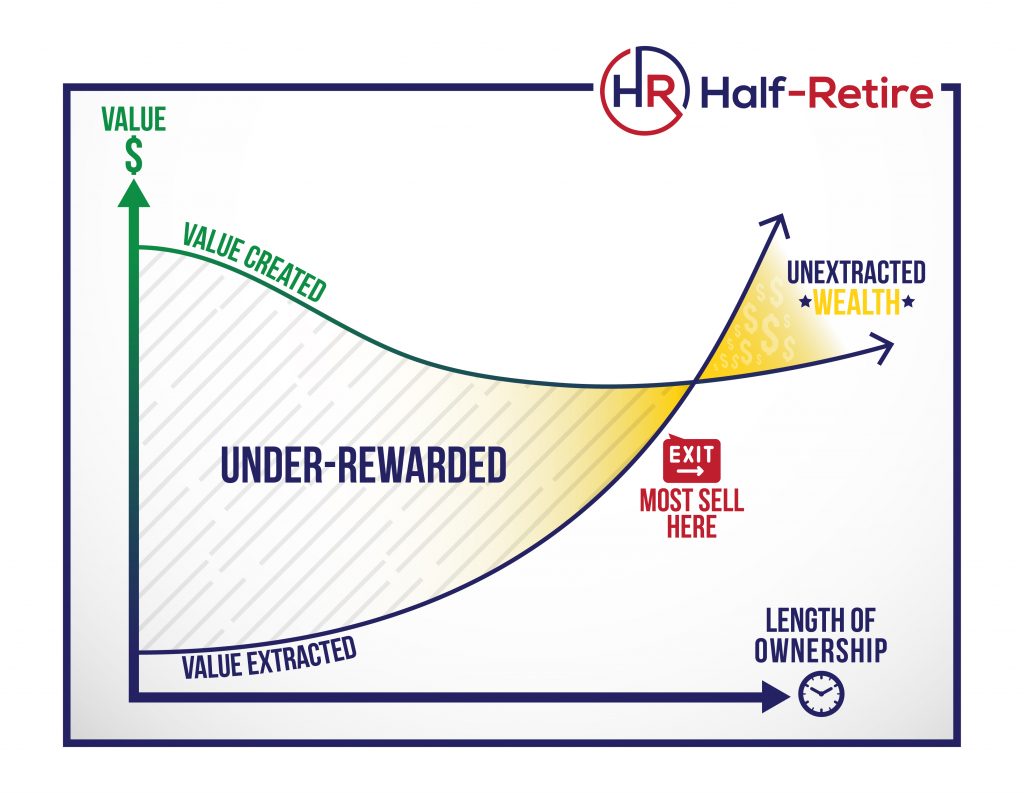

The short answer is, “Yes.” If you time the sale wrong, you could leave untapped value on the table.

Do you recall the early days of your business? If you are like most owners, you worked very hard for very little pay, perhaps for several years, in order to launch. Back then, you did not take a salary, did not have a company car, and did not have any perks, just work – hard work. During this phase, your reward was growth, and that worked!

Now the business is more successful; you enjoy lots of nice perks, a big salary, dividends, and more. The work-reward ratio has flip-flopped. In the early days, you were under-rewarded for your hard work. Now, you may be over-rewarded. Don’t misinterpret what I’m saying here. I’m not saying you are overpaid. You are just getting back the rewards you earned for all your early hard work.

If you sell the business before being “paid back” for all your sweat equity, you might be giving all your efforts to the buyer. The chart below represents the inflection point where you have earned the right to flip the effort-reward ratio.

There’s an old adage: “Business owners don’t sell out; they bail out.” If you get frustrated and bail out by selling too soon, you will lose the opportunity to extract a great deal of wealth which you have rightfully EARNED.