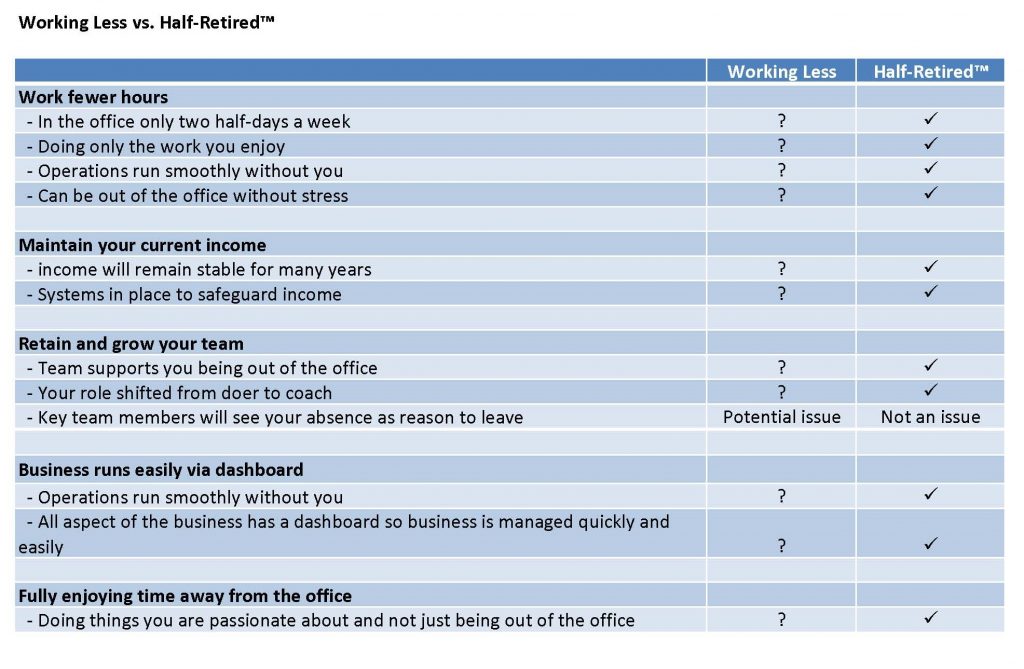

As you contemplate your exit strategy, consider the differences between “working less” and Half-Retirement™. Business owners work too hard and should definitely work less. However, when business owners pull back their efforts without a plan, they can experience disastrous results. We have created the table below comparing Working Less vs. Half-Retired™.

We see several scenarios repeating themselves over and over when an owner simply stops showing up as often vs. executes Half-Retirement™correctly. Read more about each scenario below.

Scenario #1: The Ostrich

In this scenario, the business owner reduces the amount of time they spend at the business and cannot be bothered with the inevitable problems their absence causes. Problems are so much easier to deal with when you pretend they don’t exist. Eventually, the issues transition from minor to major due to neglect and profitability suffers. The owner is left with the tough decision to stick with retirement and risk losing the business or jump back in and fix the problems. This version of “Half-Retirement™” is more like an expensive vacation. The owner takes a bunch of time off but has a steep price to pay when the fun is over. It doesn’t have to be this way. You can have both time away from work and a business that runs well.

Scenario #2: The Hot Potato

This one is also known as, “Hand it off and assume your people will catch it.” Running a business can be exhausting, especially if you have done it for decades. Passing off work to your team the right way takes way too much time and effort when you are already exhausted. So what do you do? You simply pass the hot potato to the team and assume they will figure it out. Surprisingly, this works sometimes! People step up and some previously unidentified superstars grab the reins. Most of the time, the owner enjoys some time off then is forced to re-enter the business and retake possession of the hot potatoes. Like the Ostrich Plan, this version of “Half-Retirement™ ” is more like an expensive vacation. The owner takes a bunch of time off but has a steep price to pay when the fun is over.

Scenario #3: Trojan Horse

In this scenario, the owner winds down their involvement. At first, everything appears to be fine, but in the background things are slowly disintegrating. Just like it’s hard to tell if the horse is planning to run out of the barn; it’s hard to see if problems are brewing until they are actual problems. If the owner is lucky, the problems are minor and can be fixed. However, we have seen disastrous situations where the ”problem” which is brewing is that the most important customer is growing dissatisfied, but no one sees the signs. By the time the organization figures out the problem, it’s too late, the decision to buy elsewhere has been made and the business is in jeopardy.

Scenario #4: Just Leave

Let’s call this plan hot potato squared. In this scenario, the business owner is so fed up, they no longer care. The just leave. They say something like, “Whatever happens happens.” You can guess the rest of the story.

Scenario #5: Installing an Under-qualified “Mini-Me” Ninety percent of the business owners we talk to go straight to the Mini-Me Plan to execute Half-Retirement™. It’s simple: get someone to do the work you do and then Half-Retire®. Here’s the problem, the Mini-Me Plan is a) not simple, and b) rarely can be executed. The plan is not simple, because moving work from one person to another requires someone with experience, training, skills, authority, and aptitude. Someone you hire typically does not have all these skills and business owners do not have the patience to invest the time needed for employees to learn them. Therefore, the delegation fails.

However, those reasons are not the primary reason the Mini-Me Plan fails. It fails because it cannot be funded. What is the fair market value of all the work you do in the business? What would it cost to replace yourself with someone with the exact same skills? Let’s call it $200,000 a year plus or minus. If you hire Mini-Me, you take a $200,000 pay hit. With the Mini-Me plan, even if you can pull off the delegation portion, you still have to fund it out of your own pocket. That’s a deal-killer for most owners.

Don’t fret; there is a way to offload your work other than the Mini-Me Plan. Attend one of our workshops to see how business owners are pulling off Half-Retirement™ without paying someone to sit in their chair.

Scenario #6: Not Moving With Enough Urgency

This is the scenario that is the most frustrating. The business owner recognizes they have an issue. They see Half-Retirement™ as the perfect solution to a difficult-to-solve problem – then they move slowly or not at all.

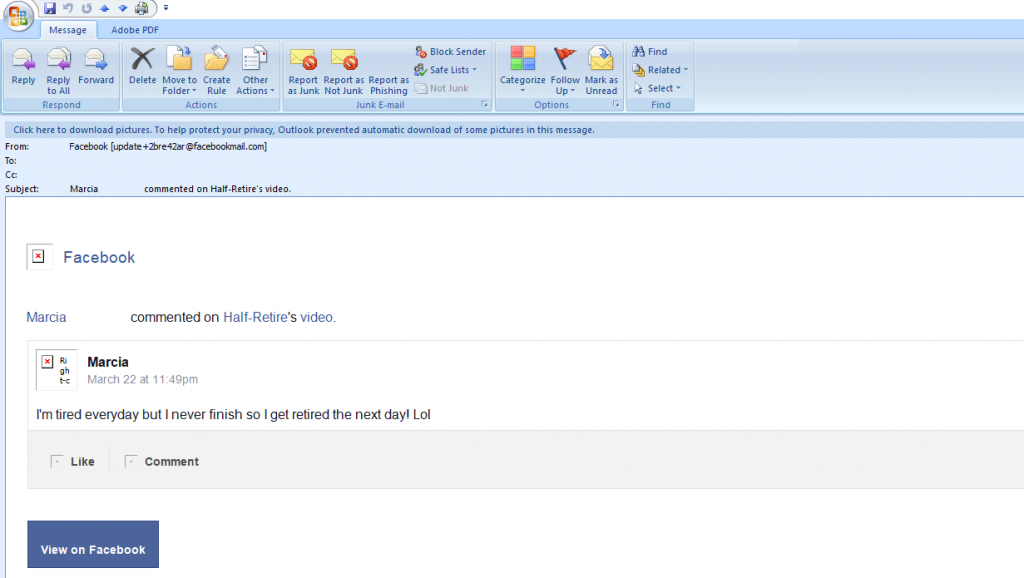

The note we received from a business owner below is typical. Most of the notes say something like, “If I weren’t so busy running the business, I could work towards Half-Retirement™.” In computer science, they call that an endless loop. It just keeps going around in the same circle. This is such a common occurrence with business owners, I put it in my book The 51 Fatal Business Errors and How to Avoid Them.

It doesn’t matter if you want to sell your business or Half-Retire®, if you can’t get out of the hectic work, you cannot sell the business or Half-Retire®. Half-Retirement creates a variety of mechanisms to remove you from the maintenance work and shift your time to the high-value work you enjoy. There’s no need to feel like work is drudgery or a never-ending list of to-do items. If your days feel like that, you may be settling for less than you should. Owning a business for a long time can grind you down and make you feel a lot of “have tos.” We work with clients to reset some of these mindsets and help them enjoy their businesses more.

How are you doing with your exit plan? Please tell us about any successes, failures or best practices in the comments section. Remember, you can have both time away from work and a business that runs well.