Go ahead and Google “exit strategies.” The five standard exit strategies below appear.

Five Most-Common Strategies for Business Exit

- Sell the Business to Family or Friend

- Sell the Business to Employees

- Merge or Get Acquired

- IPO

- Liquidate or Quit

For quite a few business owners, none of these methods create a desirable outcome. Here’s a typical example:

Samuel owns a profitable 3rd-party employee contracting business nets him $500,000 a year. He doesn’t have any family members or friends that want to take over the business. The employees can’t afford to buy it and probably don’t want to. The business is not large enough for private equity firms to be interested in, and a public offering (IPO) isn’t viable. Liquidation seems silly as the business is profitable.

The only remaining option is a sale, merger, or rollup by a competitor. Samuel checked into selling the business, but the valuation came back at only $1.5M to $2M.

After figuring commissions, legal fees, and taxes, Samual would reduce his proceeds by at least twenty-five percent, giving him a maximum of $1.5M. That’s not enough for Samual to maintain his lifestyle or not fret every penny he spends in retirement.

What does Samuel do? If he keeps slogging away until his health gives out, or he gets tired of the daily grind, he will have to settle for around $1M for his $500,000 per year annuity. Ouch.

A business owner with less than $750,000 profit in an industry with a price-to-earnings multiple less than six or seven (i.e., a business not high tech, patentable, SaaS) is probably in the same situation as Samuel. That is, you have a valuable income stream from the business, but that income stream is far more valuable to you than to any outside buyer.

Fortunately, there’s a sixth exit strategy that’s gaining momentum, Half-Retirement. Half-Retiring is defined as:

Working as much or as little as you’d like. Doing only the work you enjoy and keeping your income stream in perpetuity.

An exit strategy of Half-Retirement is a viable method for many business owners to get full value from their business, and it has a hidden benefit.

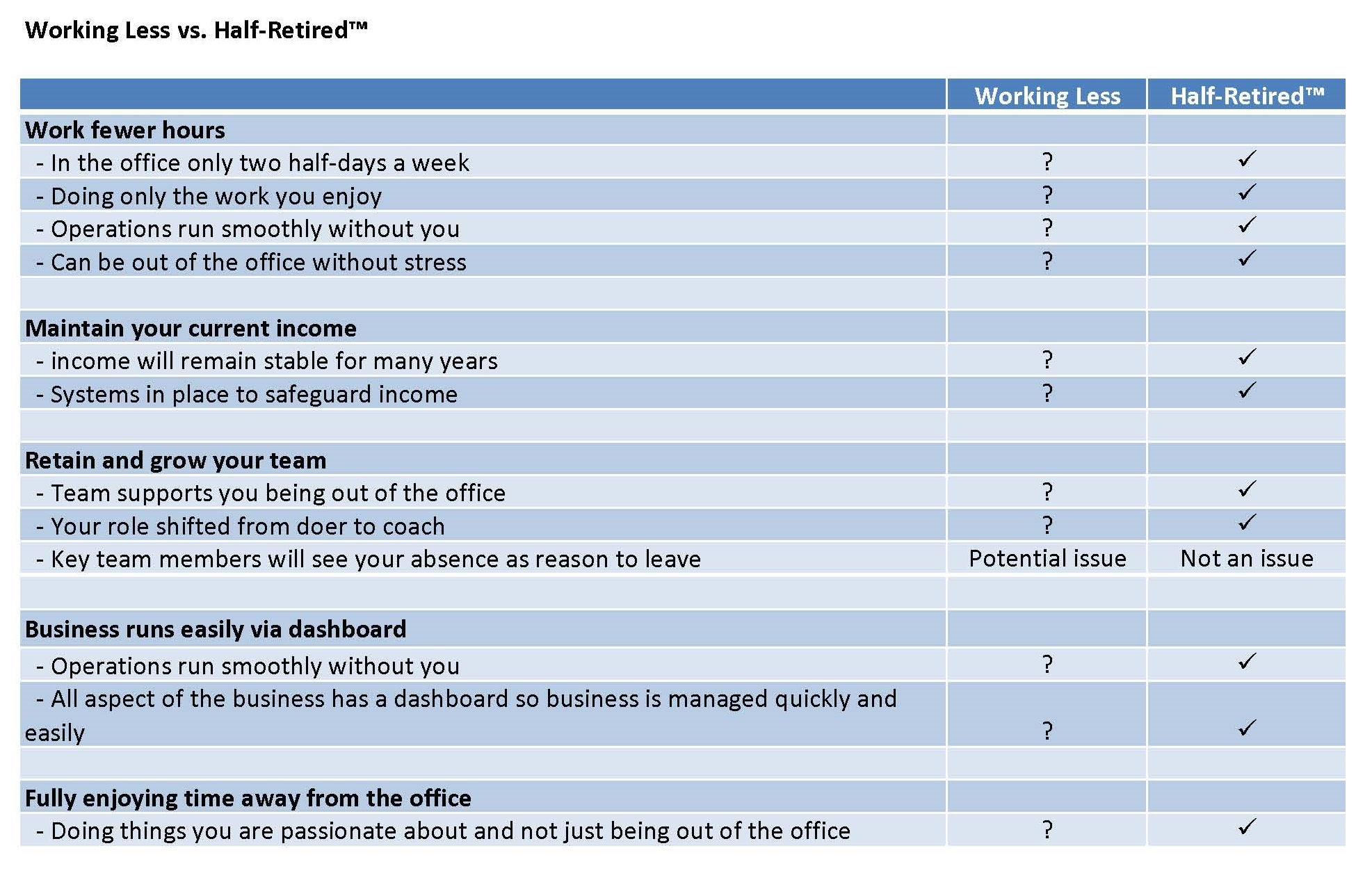

A Half-Retire exit strategy is different than working until you are too old to keep working. If you work until you can’t anymore, you will be forced to settle for whatever offer you can get. Usually, that offer isn’t very attractive. The chart below compares a Half-Retirement exit strategy to working longer. You can read the detailed article on this topic (working less vs. Half-Retired here).

The biggest risk of maintaining your status quo is “hitting a wall.” No one ever thinks they will hit a point where they just can’t take the headaches of business ownership anymore, but it happens to everyone.

The biggest risk of maintaining your status quo is “hitting a wall.” No one ever thinks they will hit a point where they just can’t take the headaches of business ownership anymore, but it happens to everyone.

Today, you feel fine putting up with cleaning up the messes employees make, working longer hours than you should, and playing the catch-all for all the work no one else can or will do. Each passing year, this “daily grind” wears you down until you can’t take it any longer.

For owners who have not worked to make the business less dependent upon them, it may be hard to sell the business for a reasonable price. Why? Because now you’re desperate, and you can’t take it anymore. You just want out.

By using Half-Retirement as the exit strategy, you can avoid this disaster. Half-Retirees can create a business that is far less dependent upon them. When the time comes to sell, buyers will be excited to buy a quality business with less hidden risk than the others for sale. That should yield a quick and profitable transaction when you decide to sell.

To learn more about the six-step Half-Retire process, download the Blueprint to Half-Retirement.