Business Valuation, Exit Planning, Retirement, Selling the business

You probably got excited that I will take a zero percent business brokerage fee…and I will under certain circumstances like the one below. We sent a small batch of emails, and several came back, such as the one below. We also had business owners who died on the job,...

Business Valuation, Exit Planning

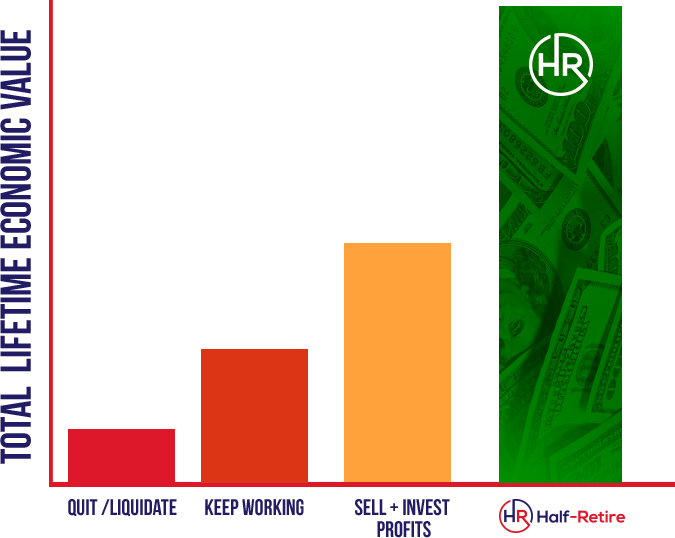

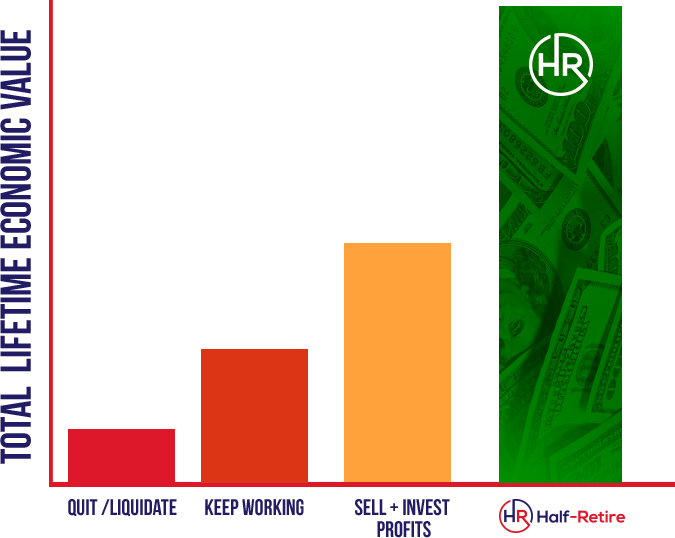

Go ahead and Google “exit strategies.” The five standard exit strategies below appear. Five Most-Common Strategies for Business Exit Sell the Business to Family or Friend Sell the Business to Employees Merge or Get Acquired IPO Liquidate or Quit For quite a few...

Business Valuation, Mindset

Have you ever heard a business owner say something like the real-world quotes below? “I read an article that said my business is worth two times revenue.” (i.e., Sales are the real value of the business, not profits) “I never took a salary.” (My sacrifices must have...

Business Valuation, Exit Planning

When you Google “exit strategies,” you will see the five standard methods below. Five Common Exit Strategies Sell the Business to Family or Friend Sell the Business to Management or Employees Mergers and Acquisitions Initial Public Offering Liquidation Sometimes, none...

Business Valuation, Concepts, Exit Planning

There’s an old saying, “Business owners don’t sell for money; they sell because they are frustrated.” The price tag to end that frustration can be millions of dollars. In a low-interest rate economy, a big pile of cash is worth far less than an income stream. So when...

Business Valuation, Concepts, Retirement

The oversimplified formula is 3X owner’s annual “take.” If you’ve ever had a formal business valuation and then tried to sell your business, you realize the business valuation is really only an estimate and indication of what a buyer might pay if all assumptions line...

Recent Comments